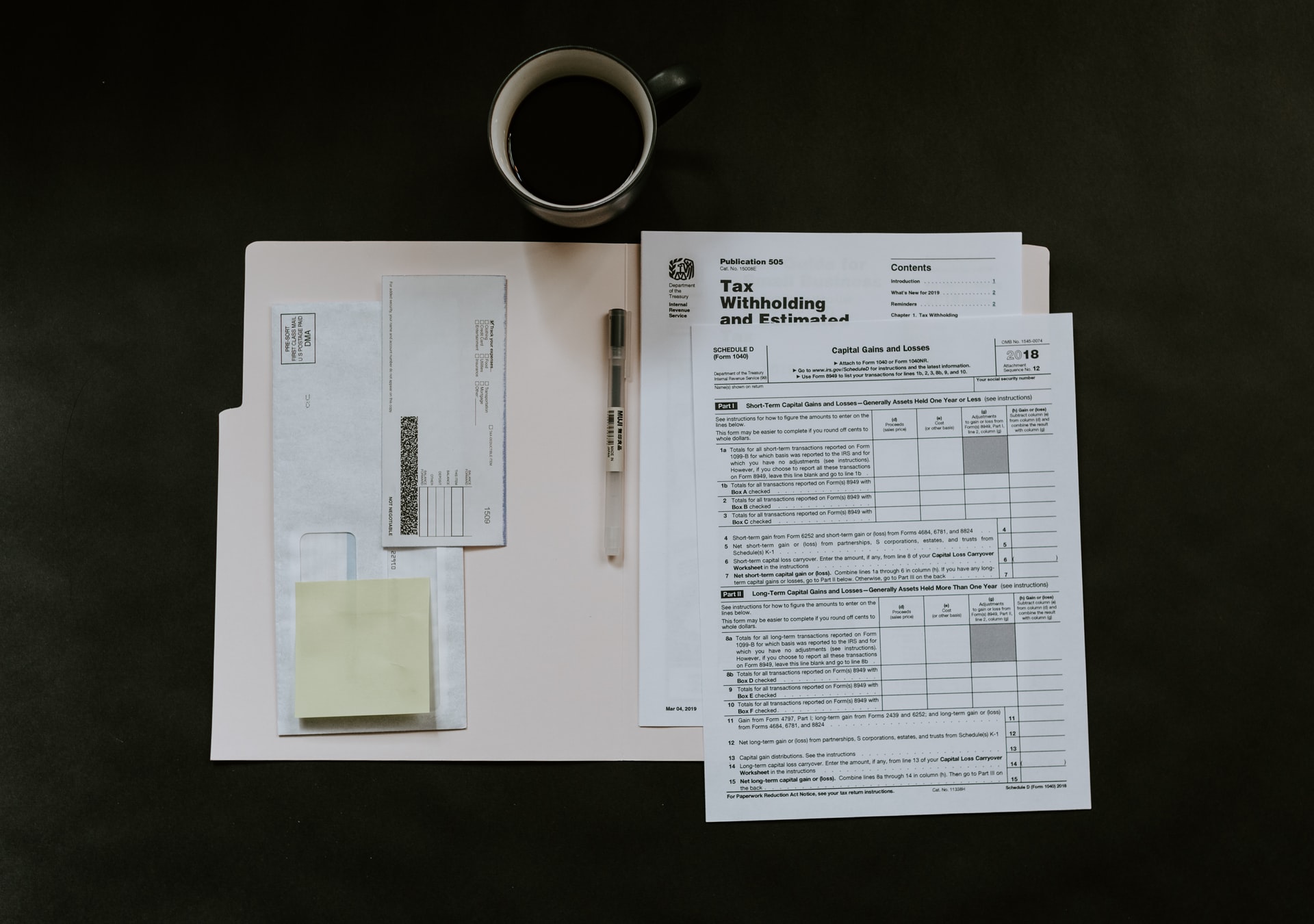

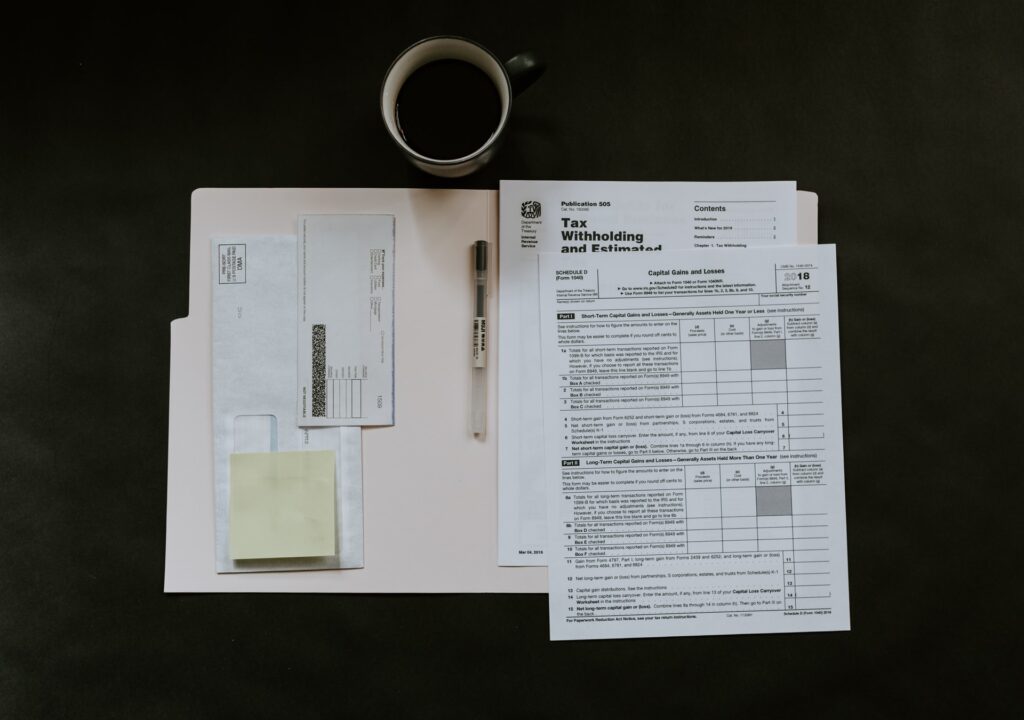

Tax season can trigger all sorts of questions for many small business owners. Words like deductions, gross income, and exemptions can be daunting, but no term strikes as much anxiety as the word “audit.”

An IRS Audit is a formal review of a business or individual’s bank accounts, assets, and financial documentation to report profits correctly and make sure they are following applicable tax laws. IRS Audits also check the amount of taxes an individual or business pays. For the most part, audits are generally uncommon. The IRS flags less than 1% of tax returns per fiscal year, but that doesn’t mean that they shouldn’t be considered when filing your taxes.

Many of the fears that exist about audits stem from unfounded myths and inaccurate information about April 15th. Here are some of the most common misconceptions and the truth behind the myths.

E-filing Triggers More Audits

About 90% of tax returns in the last two years have been filed electronically. That is a vast majority of all returns submitted. Additionally, the IRS has said that handwritten returns are more prone to human error. This makes e-filing the preferred choice to avoid an audit and to ensure accuracy.

Using an Accountant Increases Your Audit Odds

This myth is simply not true–in fact, a trusted accounting expert handling your business taxes can increase the credibility of your return and make an audit less likely. Tax accountants regularly stay abreast of changes in tax laws, understand the importance of clean recordkeeping, and are less likely to make mistakes than DIY tax preparers.

Showing Losses Can Cause an Audit

Profit and loss are part of any business. Legitimate business expenses can and should be claimed, and doing so can offset a business owner’s tax liability. Many times, showing a loss can greatly offset the amount of taxes a business owes. Losses are almost expected, especially in the first year or two of a business. Honesty and accuracy are vital in preventing an audit due to losses.

An Audit Will Ruin Your Financial Future

Although an audit is inconvenient, it isn’t the end of the world. There is a chance a taxpayer could pay thousands of dollars in additional taxes following an audit, but extra payments are a worst-case scenario. IRS strong-armed tactics were more prevalent several decades ago, and are likely the source of this myth. However, following a restructure in the late 1990s, the agency gravitated toward focusing more on taxpayer rights, making audits a much less frightening experience.

Audits Are Always Intentional

According to the IRS, being called for an audit doesn’t mean there’s a problem; sometimes, it’s simply the luck of the draw. The agency uses statistical analysis to compare tax returns against similar “norms.” The “norms” are chosen as a random sample, which means your audit could be serving the purpose of helping the IRS find irregular returns in the future.

Western Shamrock is here to help with all your tax needs. Contact us today to schedule an appointment.