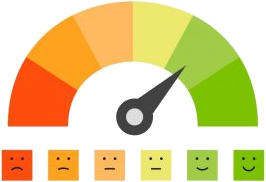

Since there are several factors that comprise your score, the length of time it takes to improve can vary. For instance, if your score is low due to a high utilization of credit cards then paying down the balances so they’re at or below 30% can improve your score within a few months. However, if your score is low due to missed or late payments, or charge-offs, which remain on your report for seven years, it may take a few years to get your score in a good standing.

The good news is that you can improve your credit score by paying your bills on time, paying down debt and using your available credit wisely.

Western Shamrock Corporation is an industry leader in the consumer installment loan business

Western Shamrock Corporation is an industry leader in the consumer installment loan business

©2023 Western Shamrock Corporation

To begin, select a state or let us detect your location

To begin, select a state or let us detect your location